SBA’s 8(a) Program: Past, Present, and Future Insights

Jan 06, 2026

Updated Jan. 22, 2026

Reading Time: ~8.5 minutes

The Small Business Administration’s (SBA) 8(a) Business Development Program has been under unprecedented scrutiny following high-profile fraud and bribery scandals that put the program in the spotlight recently (more on that below). If your firm is 8(a)-certified or planning to apply, understanding what’s happening and what has changed in 2025 is critical. Below, we break down the 8(a) program to help you understand what it means and how your firm may qualify, recent changes, and how your business can navigate it.

Program Overview: What is the SBA’s 8(a) Business Development Program?

The purpose of the program is to help socially and economically disadvantaged small businesses gain access to federal contracting opportunities. Importantly, 8(a) is a subset of the SBA’s Small Disadvantaged Business (SDB) program, so all 8(a) businesses are SDBs, but not all SDBs are 8(a) businesses. While firms can self-certify as SDBs, to qualify for an 8(a) designation, companies must specifically apply for the designation and meet the SBA’s 8(a) criteria, including:

- Be a small business (as defined by the SBA)

- Not have prior participation in the 8(a) program

- Be at least 51% owned and controlled by U.S. citizens who are socially and economically disadvantaged (as defined by 13 CFR 124.103 and 13 CFR 124.104 )

- Owner(s) must have a personal net worth of $850,000 or less, adjusted gross income of $400,000 or less, and assets totaling $6.5 million or less

- Demonstrate good character

- Demonstrate the potential for success, typically with at least two years in business

How Long Does 8(a) Status Last?

Participation in the program is limited to a nine-year term. In limited circumstances, the term may be extended by up to one year if the firm’s principal place of business is in a federally declared disaster area and the business elects to suspend participation to recover from the disaster.

However, not every firm remains in the program for the full nine years. A firm’s participation may end early due to termination, early graduation, or voluntary withdrawal.

Termination: SBA may remove a firm from the 8(a) program before the end of its term for “good cause.” This can include fraud or false statements, loss of eligibility or disadvantaged control, failure to comply with SBA rules or approved business plan, poor contract performance, financial misconduct, or a lack of business integrity. In serious cases, particularly those involving false or misleading information, termination can also result in removal from other SBA programs and referral for suspension or debarment.

Early Graduation: SBA may graduate a firm early if it has successfully met the goals in its approved business plan and demonstrated the ability to compete without 8(a) assistance; if a disadvantaged owner is no longer economically disadvantaged; if the firm exceeds its primary NAICS size standard for three consecutive years without shifting its approved industry focus; or if excessive owner withdrawals indicate the firm no longer needs program support. For fast-growing firms, early graduation can be a sign of success, but it also requires careful planning to avoid prematurely losing program benefits.

Voluntary Withdrawal: A firm may choose to leave the 8(a) program at any time before the end of its term, including by voluntarily early graduating if it has substantially achieved the goals and objectives in its approved business plan.

How Do Businesses Benefit From the 8(a) Program?

Businesses, especially very new and very small businesses, can benefit from the 8(a) program in a variety of ways. For example, businesses in the 8(a) program can receive hands-on business development support, including training, guidance from SBA specialists, and mentorship through the SBA Mentor-Protégé Program. They can also form joint ventures to strengthen their competitiveness.

In certain settings, they may also face less competition for contracts. The federal government limits competition for certain contracts to small businesses. In some cases, only small businesses in specific socioeconomic programs, like 8(a), are eligible. This reduces the pool of competitors and makes it easier to win a contract. These set-aside opportunities fall into two categories:

- Competitive Set-asides: Open to all eligible small businesses

- Sole-source Contracts: Direct awards to a qualified firm without a competitive bid when certain conditions are met.

The federal rules for sole-source awards are spelled out in procurement regulations and explained in congressional research summaries, but here’s the plain-English version of what they mean for 8(a) firms.

Agencies may issue a sole-source award when only one small business is realistically able to perform the work. If a contracting officer expects at least two qualified small businesses to submit offers, the contract is competed instead.

For contracts above the $250,000 simplified acquisition threshold, contracting officers must first consider the federal socioeconomic program. (e.g., 8(a), WOSB, HUBZone, SDVOSB) before opening competition more broadly. Sole-source awards also help agencies meet government-wide small business contracting goals, including goals specific to SDB/8(a) firms.

There are limits on how large 8(a) sole-source contracts can be. Most 8(a) sole-source awards are capped at $4.5 million (or $7 million for manufacturing). In addition, most 8(a) firms face a lifetime sole-source limit of $168.5 million (excluding awards under $250,000). The exception is group-owned 8(a) firms, including those owned by Alaska Native Corporations, Native Hawaiian Organizations, federally recognized Indian Tribes, and Community Development Corporations. These firms operate under different rules and can receive sole-source awards above the normal limits when the SBA accepts the contract on their behalf.

Recent regulatory updates to the FAR have also given agencies greater flexibility in using socioeconomic set-aside programs. In the past, once a requirement was accepted into the 8(a) program, it was difficult to move it to another set-aside category. Today, agencies may release a requirement from the 8(a) program and compete it under another eligible small business program, such as SDVOSB, HUBZone, or WOSB, when market research supports that approach.

While many firms have benefited from the 8(a) program, its advantages have made it a tempting target for fraud. Now the program is facing serious questions about oversight and integrity.

Recent Changes: What’s Happening with the SBA’s 8(a) Program in 2025?

The SBA’s 8(a) Program has been thrust into the national spotlight due to a series of high-profile fraud and bribery scandals involving federal contracting officials and 8(a) firms. However, fraud is not the only factor affecting the program. Regulatory and policy changes have also reshaped the 8(a) landscape in 2025, including the FAR overhaul and the administration’s reduction of the SDB contracting goal to 5 percent. These scandals and policy shifts have raised concerns about oversight, program integrity, and the use of taxpayer money.

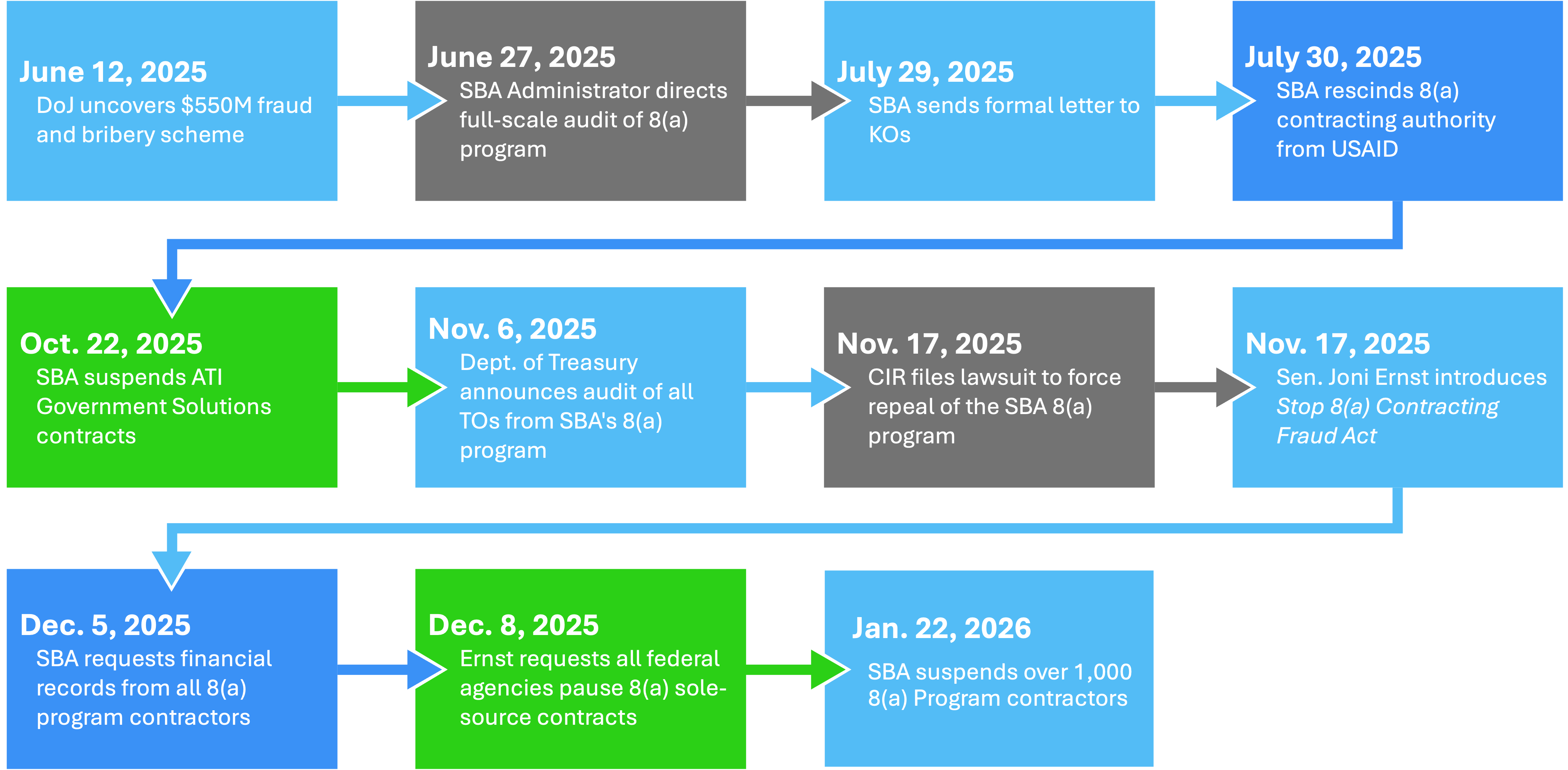

The timeline below highlights the rapid response to these scandals, including audits, suspensions, and congressional oversight.

8(a) Under the Spotlight: Timeline of Key Events

- June 12, 2025: The U.S. Department of Justice (DoJ) announced it had uncovered a $550 million fraud and bribery scheme. Those involved were a former federal contracting officer (KO) who worked for the United States Agency for International Development (USAID) and three firm executives, two from SBA-certified 8(a) firms and another who was a subcontractor to the two 8(a) companies.

- June 27, 2025: In response to the fraud and bribery scandal, SBA Administrator Kelly Loeffler directed the SBA’s Office of General Contracting and Business Development to launch a full-scale audit of the agency’s 8(a) Business Development Program, beginning with high-dollar value and limited-competition contracts within the last 15 years.

- July 29, 2025: The SBA issued a formal letter to federal government KOs informing them of their legal responsibility to uphold the law and protect taxpayer dollars, ensuring federal contract awards go to legitimate, eligible businesses. The letter emphasized the SBA’s commitment to rigorous oversight.

- July 30, 2025: The SBA announced that it would rescind the independent 8(a) contracting authority of the USAID following what it called a “massive bribery scandal.”

- Oct. 22, 2025: Loeffler announced on the social media platform X that the SBA suspended ATI Government Solutions, a tribally owned 8(a) firm majority-owned by Susanville Indian Rancheria, from competing for 8(a) contracts pending an investigation. U.S. Treasury Secretary Scott Bessent also announced via X that the federal government was immediately suspending all contracts and task orders with ATI Government Solutions pending the investigation, which he reported involves approximately $253 million in contract value.

- According to SAM.gov, ATI Government Solutions’ current status is “Ineligible (Proceedings Pending).”

- Nov. 6, 2025: The U.S. Department of the Treasury announced it will audit all contracts and task orders awarded under preference-based contracting, which total approximately $9 billion. The audit will focus on the SBA’s 8(a) Business Development Program and other initiatives that provide federal contracting preferences to certain eligible businesses.

- Nov. 17, 2025: The Center for Individual Rights (CIR) filed a lawsuit in partnership with the Wisconsin Institute for Law & Liberty in federal court to force the repeal of the SBA’s 8(a) program.

- Nov. 17, 2025: Senator Joni Ernst, Chair of the Senate Committee on Small Business and Entrepreneurship, announced that she is introducing a bill, the Stop 8(a) Contracting Fraud Act, to prohibit the SBA from awarding sole-source contracts until it conducts a full audit of and submits a report on the business development program to Congress.

- Dec. 5, 2025: The SBA issued letters to all 4,300 8(a) program contractors requiring them to produce financial records for the last three fiscal years by January 5, 2026. Loeffler said, “There is mounting evidence that the 8(a) Program designed for ‘socially and economically disadvantaged’ businesses went from being a targeted program to a pass-through vehicle for rampant abuse and fraud…”

- Dec. 8, 2025: Ernst sent letters to federal agencies requesting that they pause all 8(a) sole-source contracting and take the following actions:

- Review specific contracts identified in her letter, including the named firms and contract numbers, for potential fraud.

- Examine all 8(a) sole-source and set-aside contracts awarded by the agency since FY2020 to determine if any violate laws or regulations governing the 8(a) program.

- Promptly report back to the Committee by Dec. 12, 2025, of the agency’s decision to pause all 8(a) sole-source contracting and any findings from their investigations.

- Jan. 22, 2025: The SBA suspended over 1,000 contractors from the 8(a) Program. From GSA, "SBA suspended over 1,000 contractors from participation in the 8(a) Program after they failed to submit the documents SBA requested in December."

The timeline highlights the swift response to the recent scandals, emphasizing transparency, compliance, and accountability. Beyond these fraud-related events, broader regulatory and policy changes are also reshaping 8(a) contracting. For example, the FAR overhaul has removed the requirement to maintain certain 8(a) set-asides indefinitely, and the administration’s reduction of the Small Disadvantaged Business (SDB) contracting goal to 5% has further constrained program opportunities. These heightened oversight measures, regulatory shifts, and evolving policy priorities are likely to continue shaping the future of the 8(a) Program.

Timeline Overview

Navigating the Evolving 8(a) Landscape

If you’re considering applying for 8(a) status, based on recent events and projected changes, we anticipate it’s going to get tougher. Applicants should expect:

- More stringent eligibility reviews

- Longer processing times

- Increased emphasis on documentation and financial transparency

- Potential changes to program rules or regulations

The increased scrutiny doesn’t end with new applicants, as there will be implications for existing 8(a) firms as well. Current 8(a)-certified companies are now under intense scrutiny, with significantly higher compliance and documentation requirements. To meet the SBA’s audit, all 8(a) participants must provide the SBA with bank statements, financial statements, general ledgers, payroll registers, contracting and subcontracting agreements, and employment records for the past three years. According to the SBA, failure to comply with the Jan. 5, 2026 deadline could result in firms losing their eligibility to participate in the 8(a) Program and could lead to further additional or remedial actions. Agencies may pause 8(a) sole-source contracting, and ongoing audits and legislative scrutiny indicate that program procedures could evolve to strengthen oversight and prevent further abuses.

What Should 8(a) Firms Do Right Now?

- Get your ducks in a row: Follow SBA and federal contracting regulations to the letter.

- Documentation: Keep accurate, organized records.

- Prepare for delays: Update your business development strategy. Explore non-8(a) opportunities and teaming strategies.

- Ask the experts: Get help reviewing compliance risks.

Looking Ahead: Challenges and Opportunities

The 8(a) Program is entering an unprecedented period of oversight. For compliant, ethical firms, this period is a chance to demonstrate not only resilience but your commitment to GovCon best practices. In the long run, increased enforcement may actually strengthen the program by ensuring opportunities go to the businesses it was intended to help. If your firm stays proactive, organized, and aligned with SBA regulations, you will not only survive this transition but also emerge stronger and better positioned for future opportunities. While we can’t predict the future of the 8(a) Program, it’s one the Trident team will continue to monitor in the coming weeks and months as the dynamic GovCon landscape continues to change. If you’re considering applying for 8(a) certification and need help, don’t hesitate to reach out to Trident today.

Written by Karen Haddock

Karen is a proposal manager at Trident Proposal Management and a former U.S. Army Officer with extensive experience in project management, logistics, and education. Based on the East Coast, she supports clients worldwide as part of our globally dispersed team.